As 2024 comes to a close, companies that import tangible merchandise into the U.S. should consider available duty mitigation strategies. The Biden administration has maintained all existing Section 301 China tariffs (either 25% or 7.5% as imposed under the Trump administration) and recently announced its final determinations for steep tariff hikes on certain Chinese-origin products such as electric vehicles, batteries, semiconductors, solar cells, etc. Former president Trump also indicated his intention to more than double the existing China tariffs and impose widespread tariffs up to 20% on all U.S. imports if he is elected in November.

Duty drawback, the first sale rule (FSR), and cost unbundling can help U.S. importers legitimately mitigate the impact of normal duties, as well as the additional tariffs. These measures can have a significant financial impact on businesses’ profitability given that customs duties are an “above the line” cost, i.e., they are always cash.

Duty Drawback

Many businesses involved in importing goods into the U.S. may not realize they have a significant opportunity for cash refunds through the duty drawback program. Duty drawback is the refund of duties (including Section 301 tariffs), taxes, and fees paid on imported merchandise that is exported unused, or used to manufacture a product that is exported. Eligible drawback claims result in a refund of 99% of the duties, taxes, and fees paid on imported merchandise. A drawback request can be filed within five years from the date the goods were imported into the U.S.; the first set of drawback claims typically takes eight to 10 months for recovery but 30~45 days for claims thereafter if privileges are secured.

The main types of duty drawback are:

- Unused Merchandise Direct Identification: Merchandise unused in the U.S. that is imported and exported (or destroyed) and matched at the Product/Item No. level

- Unused Merchandise Substitution: Merchandise unused in the U.S. that is imported and exported (or destroyed) and matched at the HTS number level (U.S. customs classification system for products)

- Manufacturing Direct Identification: Components that are imported and further manufactured in the U.S. into an article that is exported (or destroyed), and matched to components of the same Product/Item No.

- Manufacturing Substitution: Components that are imported and further manufactured in the U.S. into an article that is exported (or destroyed) and matched to components of the same Harmonized Tariff Schedule (HTS) number level (U.S. Customs classification system for products)

The duty drawback process can be complex and challenging, but with the right experienced professionals, businesses can potentially unlock financial benefits. BDO’s Customs and International Trade team is equipped to assist companies in setting up new duty drawback programs or evaluating existing programs to optimize savings objectives.

First Sale Rule

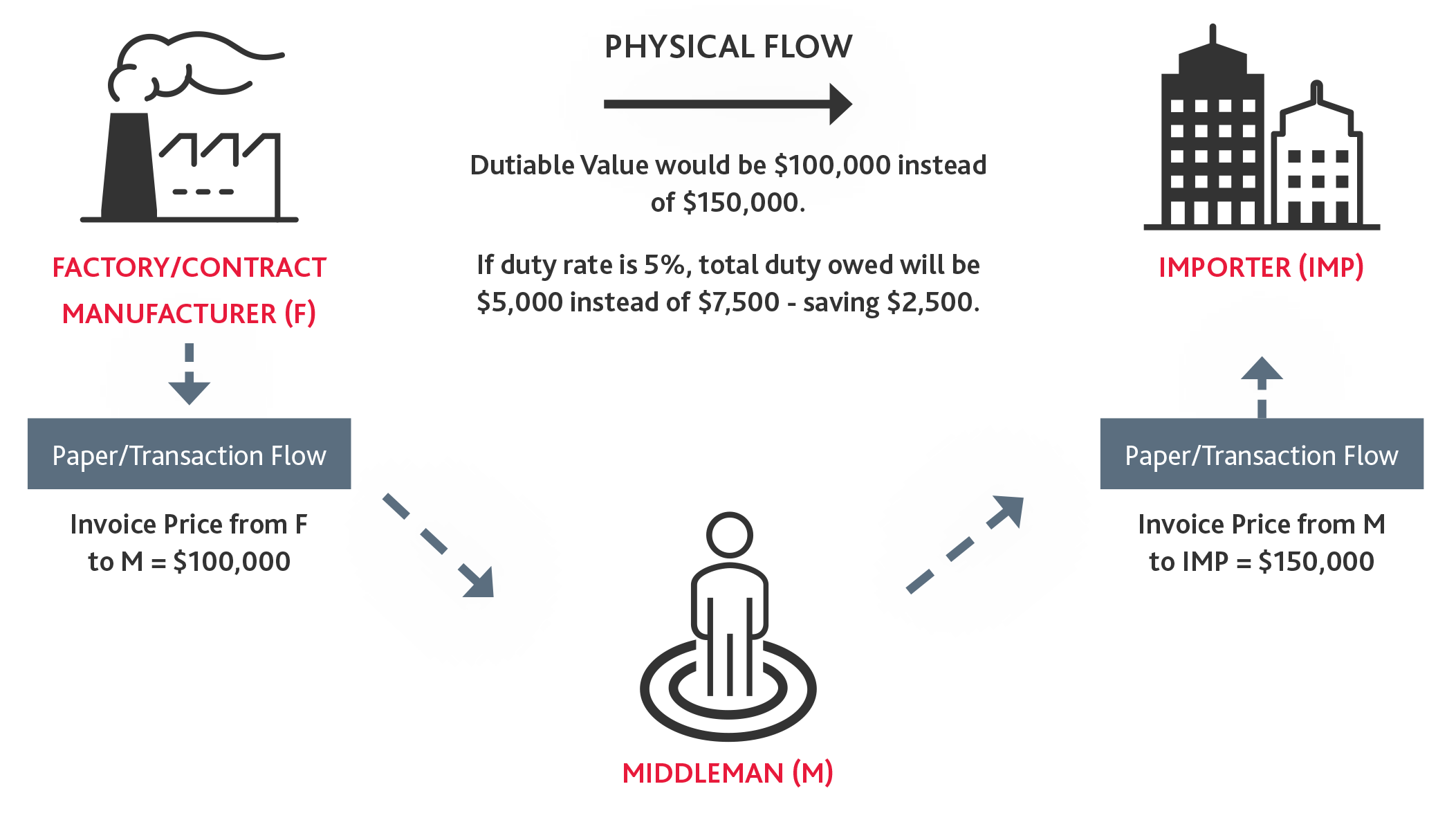

Importers must report the correct value of merchandise imported into the U.S. Under U.S. Customs and Border Protection (CBP) rules, value is normally the price reflected on the commercial invoice issued from a foreign seller to a U.S buyer. However, if an earlier sale exists in the supply chain (e.g., from a foreign manufacturer to the foreign seller), the importer may consider applying the FSR. For instance, many transactions involve the use of a contract manufacturer selling to a middleman that re-sells the merchandise to the U.S. importer. Such a scenario implicates the FSR, under which the lower factory to middleman price and not the middleman price to the U.S. importer can be used as the value reported to CBP.

Customs Valuation — FSR Illustration

Under the illustration, if the U.S. importer can satisfy specific conditions, the customs value can be determined based on the factory’s selling price to the middleman (i.e., $100,000), rather than the middleman’s selling price to the U.S. importer (i.e., $150,000). Consequently, the total duty owed by the U.S. importer can be reduced by $2,500. To import goods under the FSR, (1) the goods must be clearly destined for export to the U.S., (2) there must be a bona fide sale between the parties, and (3) the first sale value must be an arm’s length amount. Given that the FSR can reduce Normal Trade Relations (NTR) duties and additional duties such as Section 301 China tariffs, U.S. importers should consider taking steps to potentially lower the customs value of merchandise imported into the U.S.

Cost Unbundling

Businesses can consider other ways to legally lower the value of imported merchandise (i.e., the basis of duties) through cost unbundling exercises that examine key cost elements for goods to determine whether they are required to be included in customs value. For example, certain management fees, buying commissions, exclusive distribution rights fees, and U.S. R&D costs are generally considered nondutiable, so if these costs/ fees are already included in the value of the imported merchandise, U.S. importers may deduct them from the final customs value. However, given that identification of nondutiable cost elements is highly technical and has to be ascertained on a case-by-case basis, professional advice should be sought.